Why is Platinum Price Not Rising?

By David J Mitchell

February 26th 2024

CLICK HERE to download the full report in PDf version.

Before I answer the question in the title, we need to understand the overall picture correctly….

KEY TAKEAWAYS within this article in clear sections

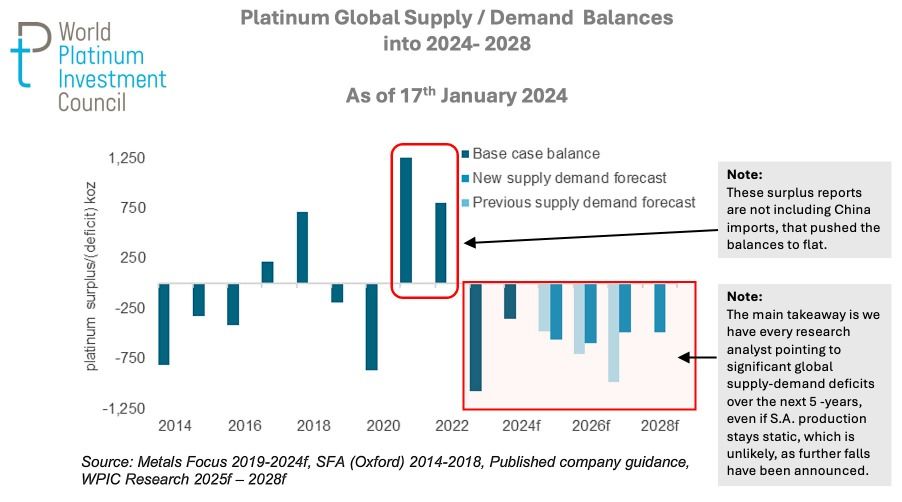

♦ Global Supply-Demand Deficits of Platinum every year into 2028, as far as official forecasts wish to forecast out too.

♦ Surplus Supply Reported in 2021 and 2022 are now known to be inaccurate and misreported. Specifically, there were discrepancies in the reporting of China's imports, which were both misrepresented and underestimated.

♦ Updates on further production declines in 2024 following on from 2022 and 2023 declines.

♦ Pricing Anomalies and how to cure low prices, a perfect storm has developed in platinum in particular.

♦ Why has platinum prices not performed over the last 3 plus years, a clear background on why and what does this mean for price now?

♦ Conclusion and price forecast on the brink of a monumental conclusion?

Please Note : PGM refers to Platinum Group Metals

PGM Basket : refers to the group of metals extracted from the mines including Platinum, Palladium, Rhodium, Ruthenium, Iridium and Osmium

After two years of purported platinum global supply-demand surpluses in 2021 and 2022, although it has come to light that these reports were erroneous as they failed to account for imports into China draining the global pool of available production and global inventory in their supply-demand equations, if they had done so correctly the global picture would have reported closer to flat or small deficits in 2021 and 2022. We have written indepth research on this situation using UN Comtrade extensive database on global import and export tracking.

See special foot-note at end of article for WPIC's own update on ‘real’ China imports.

China, despite being a non-producer of platinum, heavily utilizes the metal across various major industrial sectors, including pollution control in catalytic converters, electronics, glass production, medical applications and medicine, jewellery and the hydrogen industry, and is one of the globe's largest and most significant importers of platinum (so ignoring their true import data and accumulation of platinum reserves is somewhat bizarre).

Even ignoring the China 'real' import demand market for this precious metal, the platinum market transitioned to a significant deficit globally in 2023.

The shift is extremely notable, with reported deficits reaching close to -1,200 koz in 2023, but we will update these numbers in early March 2024 when more accurate data for 2023 should be released.

Note: WPIC is presently forecasting -1,071 koz deficit in 2023, the equivalent to 13% of projected annual demand.

In essence, this signifies a +26.14% surge in demand juxtaposed with a -2.51 % decrease in supply in 2023.

(Supply experienced a decline of -12.24% in 2022 and a further decrease of close to -3% in 2023).

Production Declines Guaranteed in 2024?

We understand the WPIC (World Platinum Investment Council) alongside research agencies SFA Oxford and Metals Focus have been forward forecasting increases in platinum production in 2024 (although their forward forecasts will again be updated sometime in March 2024), however increased production is most definitely not aligning itself with reality and the major news from all the major mining groups over the last 3 to 4 months, not forgetting of course the continued collapse of Eskom (South Africa utility grid supplier) and hence severe challenges in electricity shortages remains a significant risk.

Rising costs across the board in the face of falling metal prices within the ‘PGM basket’ of their metal type production is driving mining producers to mine shaft closures and mass staff redundancies due to unproductive or loss making production. A third year in a row of falling mine production is very much on the cards.

Some of the recent headlines over the last few months…..

Sibanye Stillwater (SSWJ.J), South Africa's biggest mining sector employer, may be forced to close some loss-making shafts, its CEO told Reuters, adding job cuts in platinum mining had become inevitable as prices of the precious metals fall.

"Significant restructuring" is very likely in the platinum sector of the world's top supplier of the metal as miners try to stay profitable, said Neal Froneman.

"We certainly can't run unprofitable shafts and I know that our cost structure is probably the lowest in the industry," he said. "So if we have loss-making shafts, which we have a few, they will have to be closed and I say this with all the sensitivities on potential job losses."

Sibanye and South African peers including Impala Platinum (IMPJ.J), and Northam Platinum (NPHJ.J), are among producers that operate some of the world's deepest platinum mines.

♦ Impala Platinum mine accident in South Africa kills 11, shaft closures

Due to falling CAPEX (Capital Investment) infrastructure failures are appearing. This latest accident took place at a mine in Rustenburg, about 100km (60 miles) north-west of Johannesburg, mine shafts have been closed at this mine until thorough inspections and investment in infrastructure has taken place.

♦ Anglo American Platinum, the world’s largest producer of the precious metal, plans to cut 17% of its workforce at its mines in South Africa due to collapsing revenue and profitability. Read here and here

Anglo American Platinum just posted a 71% drop in Net profit due to high and rising energy costs, cost of production rises and low PGM prices. They will be laying off 3000-7000 workers, which will inevitably affect the supply side of the equation.

♦ Northam and Anglo American Brace for Impact

In a startling revelation that caught the eye of investors and market analysts alike, Northam Platinum Holdings Limited and Anglo American Platinum, two behemoths in the platinum industry, have laid bare the extent of their financial tribulations. Amidst a backdrop of plummeting prices and escalating costs.

Pricing Anomalies, The Cure

Resolving pricing anomalies within the commodity sectors often surpasses the timelines anticipated by market research and forecasts. This is largely due to the distinctive characteristics of long lead times in mine production and capital investment. For instance, mining lead times can span between 5 to 8 years for the introduction of new supply. Moreover, industrial end-user demands require time to re-engineer solutions in response to commodity price fluctuations, implementing strategies such as thrifting and/or adopting alternative technologies. As highlighted by these two renowned quotes...

The solution to address a low commodity price is further lower prices…..

What they mean by this is lower prices effectively incentivizes attrition in supply capacity, thereby prompting significant cuts in production as producers aim to avoid operating at a loss. Additionally, lower prices discourage capital investment in future production, which holds particular significance in the mining industry where lead investment time to new production streams typically spans an average of around 7 years.

Moreover, lower prices tend to stimulate industrial demand for the commodity, as cost-saving measures or cutbacks become less relevant when the commodity becomes increasingly affordable. Over time, this dynamic can culminate in a near perfect storm of global supply-demand deficits, as very much evidenced by current market conditions in platinum.

The solution to address high commodity price is further higher prices….

Once again, it may seem counterintuitive, but upon closer examination and following the dots…, higher prices serve as a catalyst for expanding supply capacity for operating profits. This, in turn, triggers substantial capital investment in new supply not only from existing major producers but also attracts new entrants into direct competition, as the market becomes lucrative with ample profit margins.

Furthermore, elevated prices incentivize significantly higher rates of recycling and prompt the release of long-held static above-ground supplies into the market for sale due to lucrative high prices. Concurrently, industrial end-users are compelled to either curtail their demand or explore alternative commodity sources as replacements due to the rising expense base of the commodity in question.

Over time, this interplay can lead to a near-perfect storm of global supply-demand surpluses, as evidenced by current market dynamics, such as in the palladium sector. Here, the supply-demand deficit scarcity of palladium and the extreme price differential with platinum (where palladium was well over 3 times the price of platinum into year 2020) have prompted engineers to shift back to platinum in newly engineered BASF catalytic converters displacing palladium near completely, thereby altering market dynamics significantly, enormously in favour of platinum.

Why is Platinum Price Not Rising?

Going back to the original question, why has platinum not risen, why is the price underperforming so badly, considering all of the above dynamics?

The answer unfolds from various angles. The impact of global Covid lockdowns from early 2020 into late 2021, then followed by the global chip shortages into mid-2023 significantly affected industrial demand usage, exerting substantial pressure on price performance from early 2020 through and into 2023. The automotive industry, in particular, bore the brunt of this downturn, as semiconductor chip shortages disrupted the production of vehicles, thereby dampening platinum demand for catalytic converters. Consequently, more than 11 million vehicles had to be side-lined from production in 2021 alone.

Additionally, mining producers found themselves with substantial stockpiles of existing above-ground concentrate, which they refined and flooded onto the market in response to severe financial pressures on their balance sheets, aiming to sustain their cash flow in the face of falling PGM basket prices. This surge in supply coincided with subdued industrial end-user demand from 2020 and into 2023, further suppressing prices.

Notably, the investment sector also played a role, with significant short platinum positions exacerbating downward price pressure on the futures price exchanges.

Conclusion

We stand on the brink of a monumental shift in the supply-demand equilibrium, a phenomenon that inevitably ‘always’ unfolds with the force of historical imbalances, akin to the immutable laws of gravity and mathematics.

Faced with myriad challenges—including global shortages in the industrial supply-demand equation for platinum, above-ground stockpiles held in protected reserves inaccessible at current market prices (read China here), diminishing mine productivity due to rapidly rising costs, declining ore grades and hence unproductive production costs. Alongside a severe multi-year drought in capital expenditure investments, declining ore grades, and dwindling production capacity—coupled with escalating global industrial demand and pronounced investment disparities in short platinum positions and the need for resolution.

As market analysts, traders, and investors, we were unable to anticipate the drastic (some would say woeful) policy measures taken by sovereign governments in shutting down the world in 2020 and again in 2021, leading to prolonged global chip shortages lasting into 2023.

However, as the old saying aptly goes: “The solution to address a low commodity price is further lower prices”, we have experienced that in spades producing a perfect storm in producers now operating at losses and shrinking production supply, global supply-demand deficits every year moving forwards without new mine supply filling the deficit gap due to loss producing production and stymied recycling having much affect as platinum demand is growing, a wonderful investment opportunity moving forwards.

=======

Foot Note: WPIC update on ‘real’ China imports.

Updated estimates for 2021 and 2022 are dominated by increases in platinum surpluses for both years, but it is imperative to consider the exceptionally strong imports of platinum into China. The portion of these imports greater than identified demand, which do not show in the supply/demand analysis, were substantial enough to absorb the whole of the 2021 surplus. Although it is too early to expect the same in 2022, we note that the spot physical market remains tight, likely due to ongoing strong demand into China, for the time being at least, supplemented by Russia concerns.

Putting some figures on the strength in demand from China: The estimated global supply/demand surplus for 2021 of 1,232 koz resulted from higher refined mine supply (largely the ACP inventory unwind), the reduction in NYMEX stocks and net negative ETF demand.

At the same time, we estimate that China’s identified platinum demand totalled around 2.2 moz, but according to data from Bloomberg it imported around 3.5 moz up to 1.3 moz more than its visible needs in 2021, and absorbing all of the global surplus. The drivers behind these excess imports is not completely clear at this point in time, and it could be that with loosening travel restrictions and more on the ground research, allocation of the excess imports to specific uses may be increasingly possible. However, it is unlikely that any single aspect of demand alone could explain such a significant jump. Indeed, reports from on the ground in China suggest that a portion of the additional imports are due to market players within the platinum supply chain building speculative positions in physical metal, as seen in other commodities in the past.

=======

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with IPM Group.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.